2nd Quarter 2012

We maintained our production capacity utilization rate at 100% throughout the first half of the year thanks to flexible production and sales models, achieving stable results despite volatility in DAP/MAP prices:

- Phosphate-based fertilizer sales increased 6.6% during 1H 2012, with NPK sales up 57.7% during the period;

- Revenue for Q2 2012: RUB 24,441 mln, up 0.7% y-o-y from RUB 24,278 mln;

- EBITDA for the period: RUB 8,038 mln, down 7.0% y-o-y from RUB 8,643 mln;

- Profit for the period: RUB 2,755 mln, down 54.5% y-o-y from RUB 6,056 mln.

The phosphate fertilizer market in Q2 2012

India, the largest consumer of phosphate fertilizer in the world, resumed imports in Q2 2012, which helped support demand towards the end of the period. This helped DAP prices rise from their lowest levels in 2012 of USD 495 per tonne (FOB US Gulf) at the end of Q1 2012 to USD

Soft commodities prices remained near historic highs, although farmers remained cautious about the sustainability of prices, thus somewhat dampening the traditionally supportive effect this has on fertilizer demand.

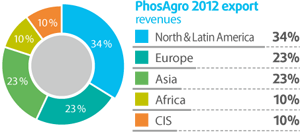

In all regions other than India phosphate fertilizer stocks were generally at very low levels; while demand remained strong in Q2 2012, farmers primarily in the US and Europe delayed purchases until the actual application season started. Demand from Brazil remained strong, helping make North America and Latin America the top region for PhosAgro’s export sales in the second quarter of 2012.

Key Corporate Events

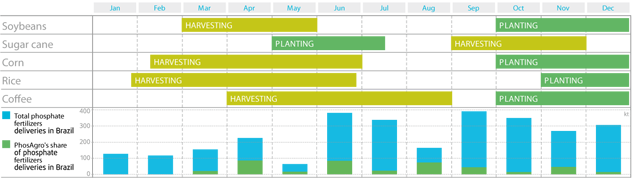

Brazil

Phosphate fertilizer application in Brazil peaks at the end of the third quarter and into the fourth quarter, when most planting seasons begin. However, we normally ship the highest volume of phosphate-based fertilizers to Brazil much earlier — in the second quarter of each year. This lag effect is due to logistics constraints at seaports: in order to secure sufficient supplies when they are needed, Brazilian customers must start purchasing three to four months in advance.

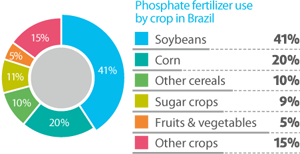

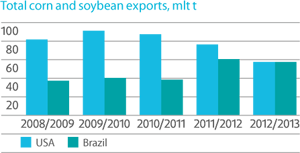

Soybeans and corn account for over 60% of phosphate demand in Brazil...

...and the region accounted for 34% of PhosAgro’s 2012 export revenue

The lag effect caused by logistics constraints meant that North and South America accounted for the highest portion of our export revenues during April-June 2012.

Brazil’s rising exports of corn and soybeans, reflecting higher overall output of these crops by the country’s farmers, support continued growth in demand for phosphate-based fertilizers.

Source: PhosAgro, IFA, USDA, SiscoMex