3rd Quarter 2012

Our strong sales and financial performance continued in the third quarter, and our share price significantly outperformed DAP prices during the period.

- Sales of phosphate-based fertilizers increased 7.2% in 9M 2012; NPK sales increased 59.6% y-o-y respectively;

- Revenue for Q3 2012: RUB 28,878 mln, up 16.0% y-o-y from RUB 24,903 mln;

- EBITDA for the period: RUB 10,057 mln, up 17.0% y-o-y from RUB 8,598 mln;

- Profit for the period: RUB 8,318 mln, up 124.7% y-o-y from RUB 3,702 mln.

The phosphate fertilizer market in Q3 2012

A serious drought in the US led to a sharp reduction in grain supplies and growing soft commodities prices, which approached historic highs. At the same time, seasonal demand for phosphate-based fertilizers remained strong.

After it renewed phosphate-based fertilizer purchases in Q3 2012, India’s fertilizer stocks normalised, but in all other geographies, phosphate fertilizer stocks remained at very low levels.

Key Corporate Events

India

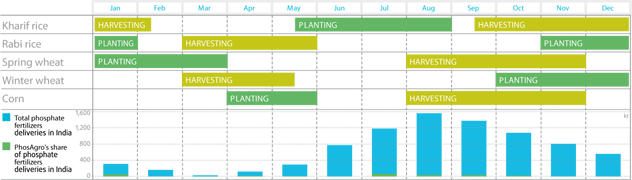

India is the largest global importer of phosphate-based fertilizers, and the country uses its significant bargaining power to put pressure on fertilizer producers between planting seasons. This means that fertilizer shipments to India peak in the third quarter ahead of the rice (Rabi) and winter wheat planting seasons that begin in the fourth quarter. By building up significant stockpiles in the second half of the year, India is able to use the first quarter of every year to negotiate prices with the world’s phosphate-based fertilizer producers. The result of these negotiations sets the price floor for global DAP prices on an annual basis.

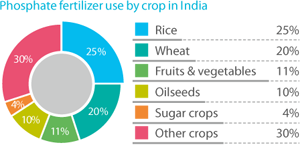

Rice is the top phosphate-consuming crop in India

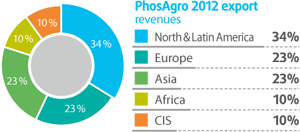

PhosAgro took steps to open new Asian markets in 2012

In 2012 we introduced sales in containers, which opened up several Asian markets that we could not previously reach, including Thailand and Vietnam. Asia, including India, accounted for 23% of export revenues and for 27% of overall sales volumes in 2012.

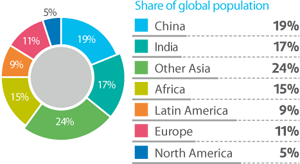

Rice is the most popular crop in the regions accounting for 41% of the world’s population

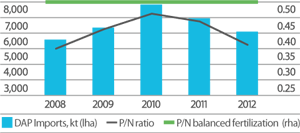

Several years of imbalanced fertilization in India have created the need to replenish phosphate levels in the soil.

Source: PhosAgro, IFA, USDA, FAI