Shareholder Information

Share Capital Indexes

As of 31 December 2012, PhosAgro’s issued share capital was RUB 311,192,700, which represents 124,477,080 ordinary shares with a par value of RUB 2.5 per share.

Stock Exchanges

Since 27 February 2013, PhosAgro’s shares have been traded on the A1 quotation list of the Moscow Exchange under the symbol PHOR (ISIN: RU000A0JRKT8).

Global Depositary Receipts (three GDRs represent one share) are traded on the Main Market of the London Stock Exchange under the symbol PHOR:

| REGULATION S GDRS | |

|---|---|

| CUSIP Number: 71922G209 | ISIN: US71922G2093 |

| Common Code: 065008939 | SEDOL: 0B62QPJ1 |

| RIC: PHOSq.L | |

| RULE 144A GDRS | |

| CUSIP Number: 71922G100 | ISIN: US71922G1004 |

| Common Code: 065008939 | SEDOL: 0B5N6Z48 |

| RIC: GBB5N6Z48.L |

Citigroup Global Markets Deutschland AG acts as the depositary for the Company’s GDR Programme.

Indexes

PhosAgro shares are included in the following indexes: MICEX Chemicals, MICEX Index, MICEX Mid Cap.

PhosAgro GDRs are included in the following indexes: FTSE Global Equity Index Series, FTSE All World Equity Index Series, Dow Jones Islamic Market BRIC Equal Weighted Index.

Share split

In December 2011, the PhosAgro Board of Directors approved a decision to issue 124,477,080 ordinary shares with a par value of RUB 2.5 per share as part of a share split, and to make corresponding changes to the Company’s Charter. In March 2012, the Russian Federal Service for Financial Markets registered a report on the results of the Company’s share issue following the conversion. The total number of ordinary shares amounted to 124,477,080 with a par value of RUB 2.5 per share.

Initial Public Offering

In July 2011, PhosAgro held its Initial Public Offering, when 1,282,000 ordinary shares were placed by the principal shareholders in the form of shares and Global Depositary Receipts (GDRs). PhosAgro GDRs were listed on the main market of the London Stock Exchange (LSE). As of August 2011, following the exercise of the over-allotment option, the total size of the offering was 1,346,109 shares in the form of shares and GDRs.

Secondary public offering

April 2013, a group of PhosAgro’s shareholders completed a secondary public offering (SPO) of 11,111,000 existing shares in the form of shares and GDRs for the price of USD 42.00. This represented 9% of PhosAgro’s share capital. The selling shareholders in the SPO committed to reinvest approximately USD 210 million (45% of the SPO proceeds) into the Company by way of the purchase of new ordinary shares additionally issued by PhosAgro at the same price per share as SPO.

Share performance

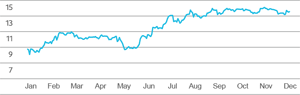

PhosAgro GDR performance on the LSE

High — USD 14.14. Low — USD 8.10.

At year-end — USD 13.60.

Trading volume — 58.2 million GDRs

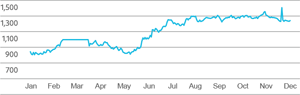

PhosAgro ordinary share performance on Moscow Exchange

High — 1,407 RUB. Low — 810 RUB.

At year-end — 1,247 RUB.

Trading volume — 770.7 thousands shares

Shareholding Structure

Shareholder structure of PhosAgro as of 31 December 2012

| Shareholder | Number of shares | Share, % |

|---|---|---|

| Dubhe Holdings Limited | 12,317,370 | 9.90 |

| Fornido Holding Limited | 12,157,625 | 9.77 |

| Carranita Holdings Limited | 11,516,400 | 9.25 |

| Dubberson Holdings Limited | 11,447,520 | 9.20 |

| Chlodwig Enterprises Limited | 10,777,880 | 8.66 |

| Adorabella Limited | 10,743,590 | 8.63 |

| Owl Nebula Enterprises Limited | 9,271,395 | 7.45 |

| Vindemiatrix Trading Limited | 6,241,470 | 5.01 |

| Evgeniya Gurieva | 6,235,960 | 5.01 |

| Vladimir Litvinenko | 6,223,860 | 5.00 |

| Feivel Limited | 6,223,850 | 5.00 |

| Miles Ahead Management Limited | 3,253,570 | 2.61 |

| Igor Antoshin | 2,489,540 | 2.00 |

| Maxim Volkov | 1,224,090 | 0.98 |

| Menoza Trading Limited | 152,517 | 0.12 |

| Other shareholders | 14,200,443 | 11.41 |

| Total | 124,477,080 | 100% |

Other ownership information

The shares of Dubberson Holdings Limited, Fornido Holding Limited, Carranita Holdings Limited, Dubhe Holdings Limited, Chlodwig Enterprises Limited, Adorabella Limited, Miles Ahead Management Limited and Owl Nebula Enterprises Limited are ultimately held on trust where the economic beneficiaries are Mr. Andrey Guriev and members of his family. The shares of Feivel Limited are ultimately held on trust where the economic beneficiary is Mr. Vladimir Litvinenko. The shares of Vindemiatrix Trading Limited are ultimately held on trust where the economic beneficiary is Mr. Igor Antoshin. The shares of Menoza Trading Limited are ultimately held on trust where the economic beneficiary is Mr. Maxim Volkov.

Dividend Payments

Proposed final 2012 dividend

In April 2013, the Board of Directors recommended that shareholders approve distribution of PhosAgro’s profit in the form of dividends, which equals RUB 19.90 per share with a nominal value of RUB 2.50 (RUB 6.63 per GDR) to shareholders included in the register of shareholders as of 22 April 2013.

Dividend history

PhosAgro’s history of dividend payments since its IPO is provided below:

Dividends paid since IPO, RUB mln

| 2011 | 7,156.8 |

| 2012 | 7,842.1 |

| Total as of March 2013 | 14,998.9 |

Total post-IPO payout ratios are: 49% from net profit attributable to shareholders; 42% from total net profit.

Dividend Taxation

PhosAgro acts as a tax agent when it pays out dividends to shareholders. The Company calculates and withholds tax on those dividends and remits the amount of tax to the relevant authorities. Dividends paid out to shareholders are net of the amount of the tax deducted. The withholding tax rate depends on the status of the shareholder. Russian residents, both individuals and organisations, are subject to a 9% tax rate, while non-residents are subject to a 15% tax rate. PhosAgro also takes into account any double tax treaties and, where appropriate, makes tax payments in accordance with the provisions of the relevant treaty.

Any existing or potential PhosAgro shareholders and holders of the Company’s GDRs are advised to consult their tax advisors for tax implications, including any tax exemptions, with regards to dividend payments.

Information Disclosure

PhosAgro strictly follows the requirements imposed by Russian securities regulations, as well as rules for the companies traded on LSE, in its information disclosure and filings. The Company publicly discloses all required information to shareholders and investors in a timely manner through authorised newswires and the corporate website www.phosagro.com.