Creating value by consolidating ownership of our production subsidiaries

Consolidating ownership of our production subsidiaries and streamlining our corporate structure will help improve efficiency, increase profits attributable to Phosagro's shareholders and simplify corporate governance. In 2012 we made considerable progress towards achieving this strategic goal.

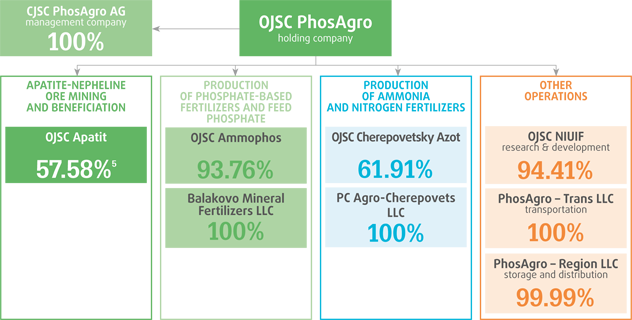

Organisational structure at IPO

auction

September-October 2012: acquisition of a 20% stake in the privatisation auction. Resulting stake: 77.58%.

USD 357 mln

nordic Rus holding

October 2012: acquisition of a 24% stake in Nordic Rus Holding (owns 7.42% of Apatit shares)

.

USD 357 mln

buyout

November 2012 – February 2013: purchase of 10.95% of shares. Resulting stake, including affiliated parties: 95.95%.

USD 357 mln

April 2013: launch of squeeze-out of remaining 4.05% of share of Apatit Resulting stake upon completion, including affiliated parties: 100%.

Est. USD 64 mln

USD 649 mln

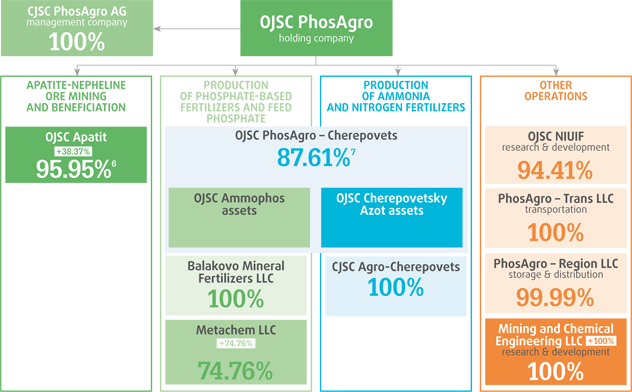

Current structure as of 22 April 2013

+XX% Change in stake of legal entities owned by PhosAgro (and affiliated parties)

6 Direct and indirect ownership of 95.95% of Apatit shares as of 22 April 2013. PhosAgro owns directly 88.52% of the share capital of Apatit. Nordic Rus Holding, an associate of PhosAgro, owns 7.42% of Apatit’s share capital. PhosAgro directly owns 24% of Nordic Rus Holding, while PhosInt Limited (49% owned by PhosAgro) owns 75% of Nordic Rus Holding.

7 Including affiliated parties.