2012 Highlights: Stable performance and organic growth

Financial

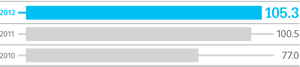

Revenue RUB bln

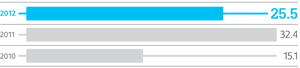

Cash Flows from operating Activities RUB bln

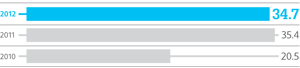

EBITDA RUB bln

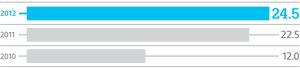

Profit for the Period RUB bln

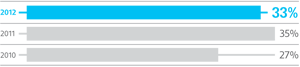

EBITDA Margin %

Profit Margin %

Dividends for 2012

- We have delivered a solid dividend yield of over 7% in 2012.

- In 2012, we paid out dividends totalling USD 1.01 per GDR.

- Our total post-IPO payout ratios are: 49% from net profit attributable to shareholders; 42% from total net profit.

- We have over-delivered on our formal dividend policy to pay 20% to 40% of annual consolidated IFRS profit attributable to shareholders as dividends.

Dividends paid since IPO RUB mln

| 2011 | 7,156.8 |

| 2012 | 7,842.1 |

| Total as of March 2013 | 14,998.9 |

In April 2013, the Board of Directors recommended that shareholders approve distribution of PhosAgro's profit in the form of dividends, which equals RUB 19.90 per share with a nominal value of RUB 2.50 (RUB 6.63 per GDR) to the shareholders included in the register of shareholders as of April 22 2013

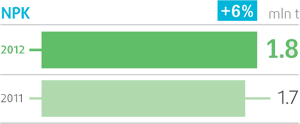

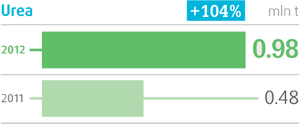

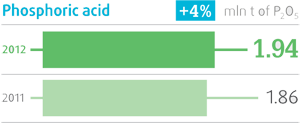

Capacity growth

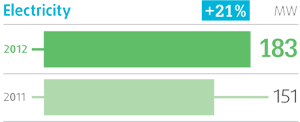

Organic growth continued in 2012 with the launch of a new urea shop and electricity plant, while M&A activity brought us the new capacities we acquired with Metachem

End products

Feedstock / intermediary products

Credit ratings

Baa3/Stable Moody's |

BB+/Stable Fitch |

BB+/Positive Standard & Poor's |

Other 2012 highlights

| Record-setting production and sales volumes |

|

| New fertilizer production and electricity generation capacity, improved labour efficiency |

|

| Growing value-added end products capacity and increasing internal processing of own phosphate rock |

|

| Significant progress towards consolidating ownership in key production facilities |

|

top