The Phosphate Industry

The phosphate industry is affected by the same factors that drive the development of the global

fertiliser market. These include the significant recovery in demand following the 2008 recession, especially in developing countries of the Asia-Pacific region, Latin America, and the Middle East, where income and diets are changing andarable land is limited. Biofuels are also becoming more popular, which is another factor driving the demand for phosphate-based fertilisers.

Unlike other players in the fertiliser market, phosphate producers have always experienced relatively stable demand. Phosphateis utilised more frequently than, for example, potash. Phosphate producers also benefit from the historically stable demand for feed phosphates and industrial-use phosphates, representing respectively 6% and 9% of total phosphate consumption.

Phosphate rock deposits are only found in a few regions of the world, and there is a small number of substantial suppliers, which means that the phosphate industry is highly concentrated. The USA, China and Morocco together account for 67% of global phosphate rock production, and the top ten countries account for 90%. Integrated producers of manufactured fertilisers use 70% of global production, with an ongoing trend towards vertical integration within the industry.

Global phosphate fertiliser consumption reached 40.7 Mt P₂O₅ in 2011, 2.5% higher than the 2010 level, as a result of strong demand from South Asia, Latin America and North America. According to the IFA’s preliminary estimates, phosphate rockproduction continued to recover in 2011, growing by approximately 5% from 2010 figures to 190.8 Mt.

World phosphate fertiliser demand is projected at approximately 42 Mt P₂O₅ in 2012, representing 3.2% growth over 2011 — higher than forecasts for nitrogen or potash fertilisers. Compared with the tight market conditions in 2011, 2012 is likely to see a slight easing in supply, depending on the availability of Chinese phosphate-based fertilisers for export.

Global production of processed phosphates (including MAP and DAP) remained strong in 2011, growing by 8.5% to approximately 31.3 Mt P₂O₅ compared to 2010. Global MAP production was up 20% to 13.1 Mt P₂O₅. Russia, the USA and Morocco contributed to this higher level of production. DAP production was static in 2011 at 15.3 Mt P₂O₅, with higher DAP production in China being offset by loweroutput in Tunisia and the USA.

In broad terms, the phosphate market in 2011 was strong with some downward pressure towards the end of the year. Prices were however supported through most of the fourth quarter by contract bookings and spot sales into the Asian and Latin American markets.

A strong growth in demand for phosphate fertilisers is forecasted for 2012 generally, and this will drive the strengthening of the market andprice increases.

|

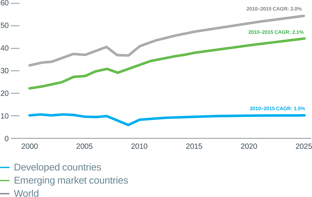

Global phosphate P₂O₅ consumption will largely

Source: IFA |

Phosphate is a consolidated industry

Source: Companies’ data, PhosAgro |